Open the Perks: Offshore Count On Solutions Described by an Offshore Trustee

Offshore count on solutions have come to be significantly prominent amongst individuals and services looking for to optimize their economic strategies. In this helpful guide, we dig into the world of overseas depends on, supplying a comprehensive understanding of their advantages and just how they can be efficiently used. Created by an offshore trustee with years of experience in the field, this resource supplies useful insights and expert suggestions. From the basics of overseas counts on to the ins and outs of tax obligation planning and property defense, this guide checks out the different benefits they use, consisting of improved privacy and privacy, versatility and control in riches management, and access to international financial investment opportunities. Whether you are a skilled capitalist or new to the concept of offshore trust funds, this guide will certainly outfit you with the understanding needed to unlock the advantages of these powerful monetary tools.

The Basics of Offshore Depends On

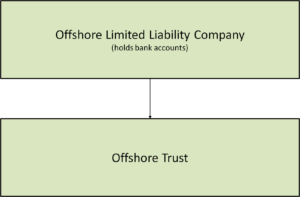

The basics of overseas trust funds entail the facility and management of a rely on a territory beyond one's home country. Offshore trusts are typically utilized for possession defense, estate planning, and tax obligation optimization objectives. By placing properties in a trust fund situated in a foreign territory, individuals can guarantee their assets are protected from possible dangers and liabilities in their home nation.

Developing an overseas depend on usually calls for involving the services of a specialist trustee or depend on firm who is fluent in the regulations and guidelines of the chosen territory. The trustee functions as the lawful owner of the properties kept in the depend on while managing them based on the terms laid out in the depend on deed. offshore trustee. This arrangement supplies an added layer of defense for the possessions, as they are held by an independent 3rd party

Offshore trusts offer several benefits. To start with, they can offer enhanced privacy, as the details of the trust and its beneficiaries are normally not openly disclosed. Secondly, they offer prospective tax obligation advantages, as certain territories might have much more favorable tax obligation routines or provide tax obligation exceptions on specific sorts of earnings or possessions held in trust. Lastly, overseas trusts can facilitate reliable estate preparation, enabling individuals to pass on their wealth to future generations while lessening inheritance tax liabilities.

Tax Obligation Preparation and Property Defense

Tax obligation planning and property defense play an important role in the tactical utilization of overseas depends on. Offshore depends on give people and organizations with the possibility to decrease their tax obligation liabilities legitimately while safeguarding their assets. One of the main benefits of making use of offshore trust funds for tax obligation planning is the capacity to benefit from positive tax regimens in foreign jurisdictions. These jurisdictions often use lower or no tax prices on certain types of earnings, such as funding gains or returns. By developing an overseas trust fund in one of these people, businesses and territories can significantly minimize their tax obligation worry.

By moving assets right into an overseas trust, people can secure their wide range from potential lawful cases and guarantee its conservation for future generations. Furthermore, offshore depends on can provide confidentiality and personal privacy, further safeguarding assets from prying eyes.

Nevertheless, it is essential to keep in mind that tax preparation and asset defense need to always be performed within the bounds of the law. Involving in unlawful tax evasion or deceptive asset security approaches can cause severe effects, consisting of fines, charges, and damage to one's online reputation. It is important to seek expert recommendations from experienced overseas trustees that can lead people and organizations in structuring their offshore trust funds in a certified and moral way.

Improved Personal Privacy and Confidentiality

When making use of overseas trust services,Enhancing personal privacy and confidentiality is a critical goal. Offshore counts on are renowned for the high degree of privacy and privacy they supply, making them an eye-catching alternative for individuals and businesses seeking to secure their assets and financial info. One of the crucial benefits of offshore depend on solutions is that they offer a lawful framework that enables people to maintain their economic affairs exclusive and protected from spying eyes.

The boosted personal privacy and confidentiality supplied by offshore trust funds can be especially useful for people who value their personal privacy, such as high-net-worth people, celebs, and experts seeking to secure their possessions from possible claims, creditors, and even family members disagreements. By making use of offshore trust solutions, people can preserve a greater level of personal privacy and confidentiality, permitting them to secure their wealth and economic interests.

However, it is vital to keep in mind that while offshore trusts offer enhanced personal privacy and discretion, they have to still adhere to relevant laws and laws, consisting of anti-money laundering and tax reporting requirements - offshore trustee. It is critical to deal with seasoned and trusted overseas trustees and attorneys who can make sure that all legal obligations are fulfilled while making best use of the personal privacy and discretion benefits of offshore count on services

Versatility and Control in Wide Range Administration

Offshore trust funds supply a considerable degree of flexibility and control in wide range administration, enabling people and businesses to effectively manage their assets while keeping privacy and confidentiality. Among the essential benefits of offshore trust funds is the capacity to tailor the trust framework to meet certain needs and goals. Unlike typical onshore trusts, offshore depends on provide a variety of options for possession security, tax obligation planning, and succession planning.

With an offshore depend on, companies and people can have higher control over their wide range and just how it is handled. They can select the territory where the trust fund is developed, allowing them to benefit from positive regulations and policies. This adaptability enables them to enhance their tax obligation placement and protect their assets from potential risks and liabilities.

Additionally, offshore counts on use the choice to select specialist trustees that have extensive experience in taking care of intricate trust funds and browsing global guidelines. This not only makes sure efficient riches administration however also offers an additional layer of oversight and protection.

In enhancement to the adaptability and control used by offshore trusts, they additionally give discretion. By holding possessions in an offshore territory, people and companies can shield their economic info from prying eyes. This can be specifically useful for high-net-worth individuals and businesses that worth their privacy.

International Financial Investment Opportunities

International diversification supplies individuals and services with a have a peek at this website wide range of financial my link investment possibilities to broaden their portfolios and minimize dangers. Purchasing global markets enables investors to access a bigger variety of property classes, sectors, and geographical regions that might not be available locally. By diversifying their financial investments across various countries, financiers can reduce their direct exposure to any solitary market or economy, hence spreading their dangers.

One of the key advantages of international investment opportunities is the potential for greater returns. Different nations might experience varying financial cycles, and by buying several markets, capitalists can maximize these cycles and possibly achieve higher returns compared to investing exclusively in their home nation. Additionally, investing globally can additionally supply access to emerging markets that have the potential for rapid financial development and higher investment returns.

Moreover, global investment chances can give a hedge versus money risk. When buying international money, financiers have the possible to gain from currency changes. If a financier's home currency damages versus the money of the foreign investment, the returns on the financial investment can be amplified when converted back to the capitalist's home money.

Nonetheless, it is necessary to note that investing worldwide additionally includes its very own set of threats. Political instability, regulatory modifications, and geopolitical uncertainties can all impact the performance of international financial investments. It is critical for financiers to carry out comprehensive study and seek expert advice before venturing into worldwide financial investment opportunities.

Conclusion

The basics of offshore trust funds include the establishment and management of a depend on in a territory outside of one's home country.Developing an offshore trust commonly requires involving the solutions of a professional trustee or depend on business who is fluent in the legislations and regulations of the selected territory (offshore trustee). The trustee acts as the legal owner of the properties held in the trust while managing them in conformity with the terms established out in the count on act. One of the crucial benefits of overseas counts on is see post the capability to customize the trust structure to meet certain needs and goals. Unlike standard onshore counts on, offshore trusts offer a broad array of choices for possession defense, tax obligation planning, and succession planning

Comments on “Secure Your Legacy: The Importance of an Offshore Trustee in Riches Conservation”